Protect Your Investment: Why Financial Due Diligence Matters Buying a small to medium-sized...

What Level of Financial Due Diligence Does My Deal Actually Need?

Why Hire a Due Diligence Provider?

It’s important to ask yourself that question before you begin any formal process. Why should you pay someone to conduct third party due diligence?

Is it required by investors? Does a bank want you to get this? Are you looking for peace of mind? If you’re a self-funded searcher or an independent sponsor, are you looking for a second set of eyes?

Peace of mind can be one of the driving factors for why you get due diligence. Asking yourself why you’re hiring someone and what you’re trying to accomplish is important before you begin.

When Banks, SBA, or Investors Mandate a Quality of Earnings

If you’re being mandated by a bank or investor, that’s often a common reason to conduct due diligence.

If you’re going through the SBA, they don’t require a Quality of Earnings. But as someone personally guaranteeing a loan, it’s very important to get a second set of eyes. You’re putting your name behind the loan, and that makes diligence critical.

Before you begin, it’s important to understand why you’re hiring someone in the first place.

What to Expect When Hiring a QofE Team

What are you looking to accomplish by hiring someone?

Are you trying to produce a third-party report to solicit investors or satisfy bank criteria? Is your goal to get comfort around the financials? Or is it a mixed bag of both?

As a financial due diligence service provider, a QofE team can be added to your deal team quickly, often within 24 to 48 hours. That’s why asking these questions early matters, even before any formal process begins.

|

|

Contributors

|

When to Engage a Quality of Earnings Provider

If you’re starting your search or actively searching, you could be in that stage for several months, even up to a year or 18 months.

The challenge with speaking to providers too early is that without a specific business or industry in mind, it’s difficult to give valuable advice on how to diligence a specific deal.

Once you identify a business you’re seriously considering and plan to submit an LOI, that’s when it becomes appropriate to book a call and reach out to a provider.

After your LOI is signed and formalized, you can quickly commence due diligence. Often your signed LOI and your Quality of Earnings project will start within the same week.

Watch the Full Webinar

You can find this and other content on my YouTube channel, including shorts, long-form videos, and guest discussions focused on buying small businesses and improving operations.

If you want to reach out on LinkedIn or X, share feedback, or suggest topics, feedback is a gift.

The 90-Day LOI Timeline

Picture this: you just signed your LOI and you have 90 days of exclusivity.

In the first 1 to 30 days, you typically start financial due diligence. The reason financial diligence starts first is because you need to verify the revenues, expenses, and net incomes presented in the SIM or marketing materials.

Without verifying that the numbers tie out to the accounting system, it doesn’t make sense to start the rest of the process.

SBA bank underwriting can begin simultaneously or a few days into financial due diligence due to the time required for underwriting.

About halfway through financial diligence, it’s best practice to begin tax and legal due diligence. If the financials check out at a high level, you then move into tax compliance and legal review, including drafting the purchase agreement and final representations and warranties.

Why Proper Sequencing Saves Money

Understanding when to engage each provider can save money.

Rather than paying everyone upfront, sequencing financial, tax, and legal diligence in the right order protects downside risk if material deal findings arise and the deal breaks.

This same framework can be applied to 30-day, 60-day, 90-day, or even longer LOI periods.

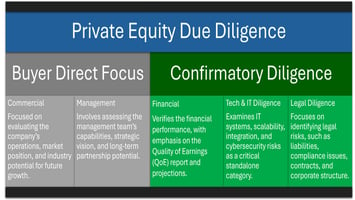

Components of a Due Diligence Process

A typical due diligence process can be broken down into seven steps.

It starts with preparation and planning, which begins once you have a specific target business. From there, data collection, kickoff calls, and assessment of the financial function take place.

Analytical procedures include reviewing the income statement and balance sheet, examining revenues, gross margins, accounts receivable, accounts payable, related parties, inventory, commitments, and contingencies.

The final step is formalizing and finalizing the results of diligence.

Adjusted EBITDA, Proof of Cash, and Debt-Like Items

The Quality of Earnings focuses on what adjusted EBITDA or SDE looks like on a normalized basis. Due diligence adjustments may raise or lower reported profits.

Proof of cash reconciles bank statements to reported revenues and expenses. It compares monthly inflows and outflows to accounting records to identify discrepancies and non-operating activity.

Debt-like analysis identifies items in the financial data that relate to a cash-free, debt-free transaction and explains how they impact the deal.

Comprehensive vs. Light Quality of Earnings

There are two common options.

Comprehensive financial diligence is typically required when mandated by banks or investors. It includes a formatted, bank-approved report and a full databook covering the entire scope of financial diligence.

A Quality of Earnings light is often appropriate for self-funded searchers pursuing SBA loans who want a second set of eyes. It focuses on high-risk areas, verifies revenues, expenses, and income, includes proof of cash, and is more budget friendly while still providing reassurance.

Free Financial Data Checklist and Webinar Series

A financial data checklist can help clarify what documents are needed to conduct due diligence or light verification.

This webinar is part of a broader series designed to empower independent sponsors, self-funded searchers, and those looking to buy private businesses with tools to do better deals and protect their investment.

Topics include proof of cash, deal structuring, financing, and the 90-day deal framework.

Key Takeaways

-

It’s important to ask yourself why you should pay someone to conduct third party due diligence before you begin any formal process.

-

Peace of mind and a second set of eyes are common reasons for hiring a due diligence provider, especially for self-funded searchers and independent sponsors.

-

The best time to engage a Quality of Earnings provider is after you identify a business and are seriously considering submitting an LOI.

-

Financial due diligence should start at the beginning of the LOI period to verify revenues, expenses, and net income presented in marketing materials.

-

Sequencing financial, tax, and legal due diligence in the right order can save money and protect downside risk if material deal findings arise.

|

|

Contributors

|

-2.jpg?width=7216&height=2657&name=02-01%20(1)-2.jpg)